Full disclosure. While technically this post is fiction, there is some truth here.

Attended a half-day retirement seminar because that is what people of our age do. The details of Social Security, pension plans, Medicare, IRAs and the like were overwhelming. Some of the attendees seemed to enjoy getting into the nuance of the details. Upon reflection, most people focus on the retirement details but not so much the big picture. This post is about the bigger picture.

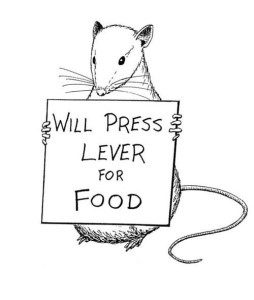

The history of the Social Security System is a detailed history of Social Security and as such, the concept of retirement. Over 20 other countries already had a similar social security system by the 1935 enactment of the U.S. Social Security System. As the industrial age took hold, the economy had shifted from primarily agricultural to manufacturing. The majority of the nation’s workers were now, factory (non-farm) workers. When a person got old or disabled on the family farm, the family was there for them. However, the factory owners let go factory workers who were no longer able to work, which was often the result of old age or disability. The large and growing number of old and disabled became a huge social problem. The solution to this huge social problem was the Social Security System. The idea was that if every worker paid a little into a trust fund, workers who were disabled or lived to age 65 or older (life expectancy at the time was about 62) could collect a small benefit and reduce the social problem.

A couple years after the enactment of Social Security (post World War II), some large companies started having benefits as a method to attract and retain workers. Pension plans were one of those benefits. To qualify for most pensions, you needed 30 years of uninterrupted service and the attainment of age 65. It took over 20 years for Pensions to become widespread. In this same timeframe life expectancy increased to the mid 70’s.

Before the enactment of Social Security, retirement was only for the rich. With the Social Security, those physically unable to work (old age or disability) could also retire. Today, the rich and disabled can still retire. What has changed over the past 50 – 60 years is the increase of life expectancy beyond the retirement age. The consequence has been people retiring because they want to quit working not only because they were unable to continue. Often there is a life-event (laid-off, hate the new boss, grandkids need playing with, medical issue, etc.) leading to the decision of when to retire. Retirement is now more often than not, a voluntary act rather than required by the inability to perform work for wages.

The average retiree works for about 45 years and is retired for about 20 years. Individual results may vary. Work 45 and retire 20 is technically wrong but are in the range of right. For non-rich people to retire, the idea is to save a share of their income during the 45 years of working, invest it to provide income for the 20 years of retirement. The “savings” is mandatory in the case of Social Security or voluntary in the case of an IRA. Saving for retirement takes on several forms but in the end, all are about saving of a portion of income while working for use when not working.

Social Security provides retirees with about 40% of monthly pre-retirement income for the rest of their life.

- Only about one third of retirees have Social Security and enough other income to maintain their pre-retirement standard of living.

- About a third of retirees have Social Security and some other source of income but not enough to maintain their pre-retirement standard of living.

- About one third of retirees have only Social Security income.

The net result is that about half the retirees have a retirement income substantially less than their pre-retirement income. Many of those with least available retirement income, made the least in their pre-retirement years. Living on 50% or less of the pre-retirement income is especially tough when the pre-retirement income was only marginally adequate. The result is a large population of the elderly living in subsidized housing and or are living in poverty.

In short, many who choose to retire really cannot afford to be retired. Telling them they should have saved more pre-retirement is not helpful because they could not afford that option. Poverty is the reality for many retirees. At the heart of the stories of dated housing, skipping medicines, putting the extra rolls from the restaurant in their purse is the reality of poverty. Again, in rough numbers about half of retirees live close to pre-retirement standard of living but about half live at a substantially lower standard of living. One size does not fit all.

Virtually all of the money saved for retirement purposes is in stocks and bonds. The Social Security Trust fund is actually U.S. Treasury Bonds. The retirement savings invested in pension plans and individual Retirement Accounts (IRAs) are some combination of stocks and bonds. Note these systems have some cash on hand to make payments but for all practical purposes, they are stocks and bonds. Between the retiree and the stocks and bonds they own is often a mutual fund or other investment product but the net result is the same, the retirement funds are most often actually stocks (ownership) in publicly traded companies or in bonds, which are most often loans for the building of some sort of public or private infrastructure. Note the infrastructure technically secures the loan.

Retirees as a group own about 40% of the total of all stocks and bonds in the country. The wealthiest 1% owns another 40%. Everyone else owns only about 20% of the value of all of the stocks and bonds. Just for scale, according to the Federal Reserve reports the pension liability for the U.S., including all types is about 19,271.4 billion dollars. (~19 trillion). According to Google the total worth of stocks and bonds in the U.S.:

- Stocks = $19 trillion

- Bonds = $30 trillion.

The estimated total net worth of the United States is $123.8 trillion. About 15% of the U.S. net worth is dedicated to be retirement income. On a macro level, increasing retirement income means increasing portion of the U.S. net worth dedicated to providing retirement income. Which means decreasing the percent of non-retirement net worth. Saving more means buying more stocks or bonds and spending less on goods and services. The weird thing is; spending less on goods and services reduces the profits of companies, which reduces the value of the stocks. Thus, the idea is not to shift more money into stocks and bonds. The idea is increase the percentage of the existing stocks and bonds owned by retirees by reducing the percentage owned by the wealthiest. It is a topic for a future post but the concentration of too much wealth with too few individuals is not a great thing.

Many of the so-called wealthiest 1% got that way via fees for managing retirement money. Others got super-rich by selling a portion of a company they own via a public stock offering. Retirement fund managers buy these public offering stocks which drives up the price and thus making the owner superrich. The bottom line is one way or another, the transfer of value from retirement savings made some individuals super-rich. Policies and practices that would somehow move value back from the super-rich to the retirement funds seems to make sense.

In 1935 (Social Security System was enacted) slightly over 50% of workers in the U.S. were in manufacturing and over 40% were in agriculture but it was on the decline. Today ~79% of the workers are in the service sector. Most of us have customer service jobs of one sort or another. Less than 20% of us work in manufacturing sector. Only 1.1% work in agriculture.

Today fewer people become permanently disabled. Jobs are less dangerous and medical treatments are much better. Knee and hip replacements have become routine. Many otherwise crippling conditions are no longer crippling. People recover from serious illness and injury. There are even laws against discriminating against the disabled. Being physically unable to do one job most often, does not preclude a person from doing other types of jobs. Physical limitations are now less likely to be the cause for someone leaving the workforce. Personal choice is the most common reason people retire.

Let us circle back to the beginning of the Social Security System. One of the main reasons we needed Social Security in the beginning was the movement of workers from the farms into the factories. The result was that the old and disabled were thrown out to the street when they could be replaced with more able-bodied factory workers. By far most of today’s workers are in customer service or supporting customer service. Health care, finance, education, government, professional / technical services, information, management, etc. are big. Certainly, there are still manual labor type jobs: farmers, construction workers, miners, plumbers, electricians, loggers, factory workers and the like, but not as many as there used to be. That said, even the manual labor jobs are being automated. A carpenter uses pneumatic nail guns instead of hammers. Factory workers operate machines that do the actual building of the products.

The times have changed and are changing more as time goes on. We are no longer in the industrial age. As we adjust to the information age, the nature of jobs is changing. Fewer people do physical work and even the physical jobs are getting less physical. For many service jobs, physical presence is not required all of the time. Many can work from home, or a cabin, or from a beach. The relationship between the physical presence of an employee and the location of the employment is changing. How all of this affects retirement is anybody’s guess.

However, certainly it will affect the concept of retirement in the future.

Conclusion

The expectation that everyone can retire comfortably does not match the financial reality of enough resources being available to do that. Many just do not make enough income during the working years to save enough to maintain their pre-retirement standard of living for 20+ retirement years. Saving for retirement does not increase the money you earn in your lifetime; it just spreads the availability of the money over a longer time. Probably the “everyone should retire as soon as they can” expectation needs to be adjusted to be more in tune with reality. Many people should work as long as they can.

That said, the concept of retirement is going to change. The current retirement system is a result of the realities of the industrial age. Now that we are in the information age, the nature of the work is changing. Many jobs allow flexibility with location, hours, days of the week worked, etc. Most jobs are automated or about to be. Co-workers, colleagues and customers live all over the globe. Lifestyle flexibility is the reality of many of today’s jobs. The idea of retirement allowing someone to escape a bad lifestyle to a better lifestyle is changing.

For many people the line between their work and non-work lives has blurred. Not that they work all of the time, but in a connected world, they can answer that customer’s question while walking through the museum or from the ballgame. Conversely, they can interact with their friends from all over the world while sitting in a cube deep in the bowels of Mega Corp.

Things have changed. The reason we got social security in the first place is less of an issue today. There is reason to believe that the old model of working 45 to retire 20 will be changing. I do not know the answer but the question of what retirement will look like 30 years from now is probably not the right question. The right question might be about a lifelong balance of work, family, travel, life experiences and the like where the concept of retirement is not as relevant. Where people work for income but over a greater portion their lifetime. The hope would be that people would be productive, active and happy their entire lives.